How Presidential Policies Could Shape the Housing Market in 2025

Presidential elections often bring changes that can impact the housing market, from policies affecting affordability to shifts in lending regulations. This post is intended to take a nonpartisan and even-handed look at how proposed policies from the incoming administration might influence housing supply, costs, and financing. Regardless of your political views, understanding these potential changes can help you navigate the market with confidence and make informed decisions about your housing goals. Please note that I’ve provided links to source material where sharing of the cited content is permitted or publicly available.

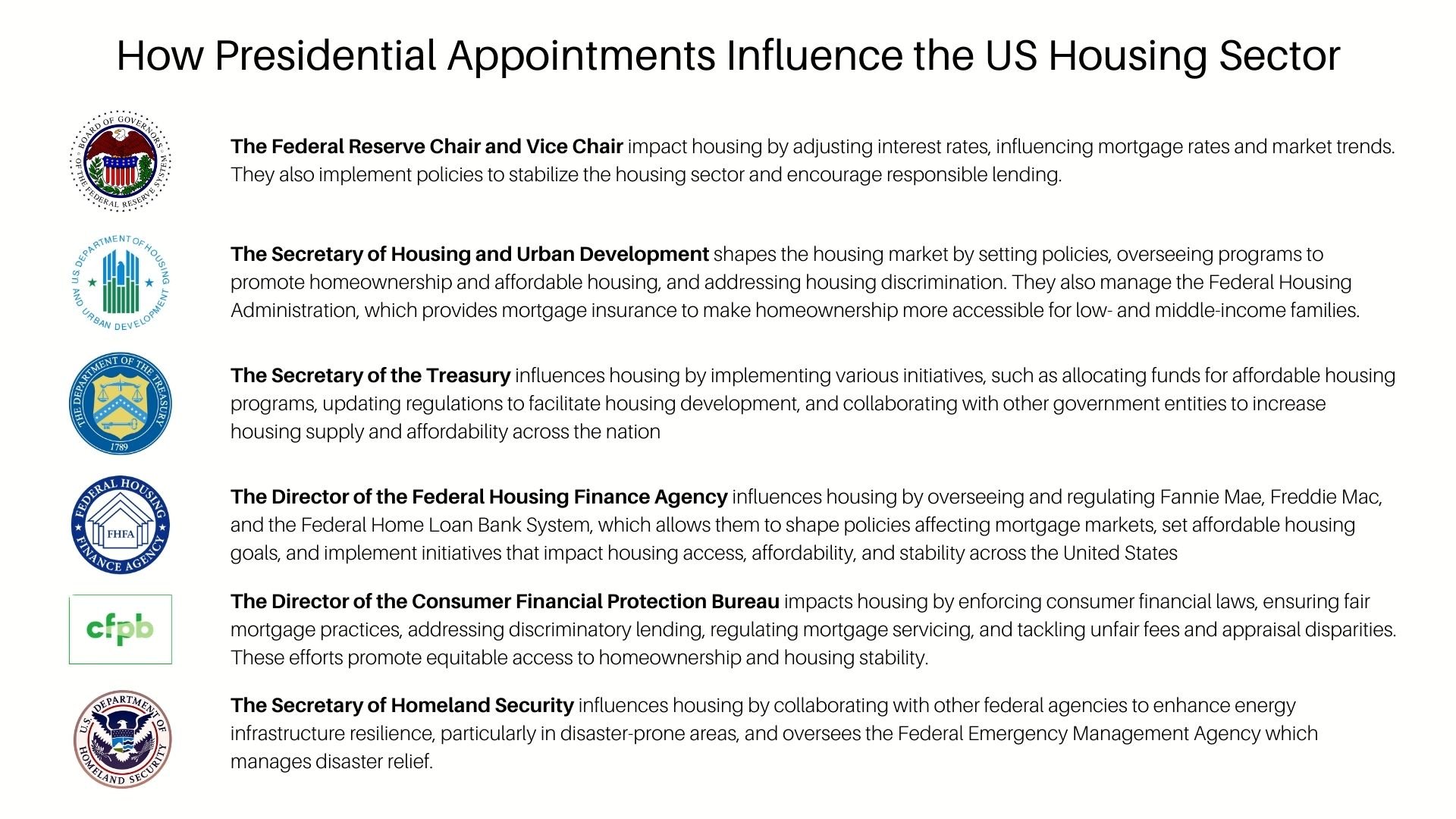

Housing Policies and Key Government Agency Appointments

The new administration is proposing several policies that could impact housing supply, affordability, and overall market dynamics. While some initiatives might ease the housing shortage, others could inadvertently worsen the situation. It's important to note that, according to Freddie Mac the U.S. housing market currently requires approximately 1.5 million additional vacant units to achieve balance—with the shortage evenly split between for-sale and for-rent housing, each category needing about 760,000 units.

Expanding Construction on Federal Land: Opening up federal land for development could help address housing supply and affordability challenges. However, regulatory, environmental, and infrastructure hurdles may slow progress. This initiative could significantly accelerate supply if developers are incentivized through tax breaks or financial benefits. The cost of lots ranges from 23% of a new home’s price in Florida to 41% in Southern California, according to a 3Q24 John Burns Research and Consulting Residential Land Survey. Brokers nationwide report that the availability of developed lots and land remains below normal levels, making this policy particularly promising in regions with land scarcity.

Developing federal lands for housing raises environmental, economic, and planning issues. It risks disrupting wildlife habitats and reducing access to lands preserved for recreation and conservation. Expanding development to city outskirts could lead to urban sprawl, longer commutes, and strained infrastructure. These projects require costly investments in utilities and services, burdening local budgets. While housing may be cheaper, higher transportation costs might offset savings. Public transit systems could also struggle with added demand. Additionally, the slow federal land privatization process and lack of guarantees for affordable housing cast doubt on whether such developments will solve housing shortages or primarily benefit high-end developers.

Some supporters of federal land development argue for targeted, sustainable approaches to address housing shortages. Focusing on vacant parcels near existing infrastructure can limit costs and environmental impacts. Existing policies like the HOUSES Act encourage affordable housing with below-market land sales and density requirements for efficient land use. Energy-efficient building practices and renewable energy integration, supported by the Biden-era Inflation Reduction Act, can create eco-friendly communities with some anticipation of less reliance on expanded infrastructure. Collaboration with stakeholders and Tribal nations ensures inclusive land management, while conservation leasing supports habitat restoration alongside development. These efforts aim to balance housing needs with environmental and community priorities. Questions remain as to whether the new administration can achieve a sustainable approach to developing public land, or if the above-cited acts will remain intact as we move ahead.

Implementing Tariffs: Higher tariffs on imported goods could drive up inflation, increasing costs for consumers and businesses alike. For the housing sector, tariffs on building materials could mean higher construction expenses, further straining affordability. This effect could be especially pronounced in the short term, as U.S. manufacturers and suppliers adjust to meet the potential rise in demand for domestic goods. While the supply chain has stabilized after years of disruptions, homebuilders and suppliers emphasize the importance of maintaining this balance to avoid future volatility.

Ending the SALT Cap (State and Local Tax Cap): Removing or raising the current $10,000 cap on state and local tax (SALT) deductions would primarily benefit high-cost housing markets, especially along the coasts. Residents in areas like California and the Northeast would see the greatest financial relief, which could boost these already robust markets. For example, the Burns Home Value Index shows that home prices in Orange County, CA, and the New York metro area rose 7% year-over-year, compared to a national increase of just 3%. Here in Arizona, this would likely only benefit the owners of ultra-luxury homes.

Reducing Regulations: Easing regulations could reduce construction costs and speed up new development. However, such measures might raise concerns about environmental impacts and quality control. Financial services deregulation is particularly worth monitoring, as it could influence mortgage lending practices and underwriting standards. Federal oversight of Fannie Mae, Freddie Mac, FHA, and VA loans—responsible for 61% of first-lien mortgage originations in 2024—remains critical to maintaining stability in the mortgage market.

Inflation and the Economy

High Inflation Expectations: Inflation is projected to remain elevated in the coming years due to ongoing economic growth, uncertainties surrounding trade policies, and concerns over government spending. These factors have historically led to rising long-term interest rates, which in turn increase borrowing costs for both homebuyers and builders. Arizona's real estate market, known for its adaptability, is expected to manage these challenges as it continues to attract buyers and investors.

Higher Mortgage Rates: The Mortgage Bankers Association (MBA) has released its latest forecast for 2025 mortgage rates, projecting them to range between 6.4% and 6.6%. This outlook reflects growing economic uncertainties and potential inflationary pressures. The MBA expects rates to hold steady at 6.3% into 2026.Other major forecasts align with this higher rate projection. Fannie Mae now anticipates 2025 mortgage rates at 6.3%, while Bright MLS predicts rates will average about 6.4%, dropping to 6.25% by the end of 2025. Realtor.com suggests rates will hover around 6.3% for most of the year, with a slight decrease in the fourth quarter.These higher rate projections have led to adjustments in other housing market forecasts. The MBA has revised its mortgage origination volume for 2025 down to $2.1 trillion, with existing home sales projected at 4.25 million. These figures are lower than previous estimates, reflecting the potential impact of sustained higher mortgage rates on housing affordability and demand.

Builder Optimism: Builders nationwide, including Arizona’s, remain optimistic. They view a robust economy with stable demand as preferable to the uncertainty of a recession. Builders also leverage strategies like mortgage rate buydowns to attract buyers, helping them maintain an edge over resale homes. Recent forecasts indicate significant growth in new home construction for 2025, with projections showing strong market recovery. Realtor.com’s 2025 Housing Forecast shows that single-family housing starts are expected to surge by 13.8%, reaching 1.1 million homes. ConstructConnect projects a more modest 12% increase in total residential starts for 2025, including single- and multi-family construction, but taken as a whole, these predictions suggest the new-construction market's resilience and ability to adapt to evolving economic conditions.

Immigration Trends and Housing Demand

Declining Immigration Rates: According to the Congressional Budget Office (CBO), net immigration to the United States is projected to decrease from 3.3 million in 2024 to 2.6 million in 2025 and further decline to 1.8 million in 2026, though these figures remain significantly higher than the 2010-2019 average of 900,000 per year. While this trend could impact housing demand, research from Harvard's Joint Center for Housing Studies suggests that immigration's effect on housing costs is relatively modest, with a 1% increase in immigrant population correlating to a 1-1.6% rise in rents. Importantly, immigrants contribute significantly to housing supply, comprising 34% of construction trade workers in 2023, potentially offsetting some demand-side effects.

Impact on the For-Sale Market: While immigration significantly affects the rental sector, its influence on the for-sale housing market is more nuanced. Recent data shows that out of the 700,000 new households formed due to immigration, 100,000 were homeowner households. This suggests that while immigrants contribute to homeownership growth, their impact is less pronounced than their effect on the rental market. The homeownership rate among immigrants tends to increase with longer residency in the U.S., indicating a gradual rather than immediate impact on the for-sale market.

Construction Labor Shortages: Research from the Center for Immigration Studies indicates that in 2021, immigrants (both documented and undocumented) made up 29% of all construction workers. The same source estimates that, based on data through 2016, undocumented immigrants hold about 15% of construction jobs.

It's important to note that exact figures for undocumented workers can be challenging to determine due to the nature of undocumented status. The percentages may vary depending on the source and methodology used

Deportations and Housing Market Implications: Deportation rates have fluctuated across administrations, with stricter immigration policies often leading to higher deportations. A recent report by Redfin suggests that mass deportations could significantly impact the housing market, potentially reducing U.S. housing wealth. Both rental and owner-occupied sectors could feel the effects, as fewer households would create a ripple effect across housing demand and pricing.

In Conclusion

No matter how things play out, the housing market is likely to be deeply influenced by a variety of factors, including federal policies, economic trends, and immigration dynamics. This post aims to provide an unbiased overview of how the incoming administration’s proposals might shape housing supply, affordability, and financing. By focusing on citable research and data, it’s my hope that this informs readers about these critical issues, regardless of political stance. Understanding these potential changes is key to making informed decisions in an ever-evolving market.